Did you know that Warren Buffett, often hailed as one of the greatest investors of all time, has a net worth that rivals the GDP of some countries? In this article, we delve into the life of the Oracle of Omaha, exploring not just his staggering financial achievements but also his personal journey, including his age, wife, and the principles that have guided him. Understanding Buffett’s story isn’t just about wealth; it’s a lesson in patience, strategy, and humility that can inspire anyone looking to navigate their own financial path.

What if I told you that the secret to financial success might lie in the wisdom of a man who still lives in the same modest home he bought decades ago? This article takes you through the fascinating life of Warren Buffett—his impressive net worth, his age, and the woman by his side, Susan Buffett. By examining his life and choices, you’ll gain valuable insights into how Buffett’s philosophies can empower you to make smarter financial decisions in your own life.

Imagine amassing a fortune so vast that it could fund several charities for generations to come—all while maintaining a down-to-earth lifestyle. Warren Buffett’s net worth is not only a reflection of his investment genius but also a testament to his values and relationships. In this comprehensive guide, we will explore Buffett’s age, his enduring marriage, and the life lessons he embodies, giving you a deeper understanding of what truly defines success beyond just numbers.

Warren Buffett Net Worth

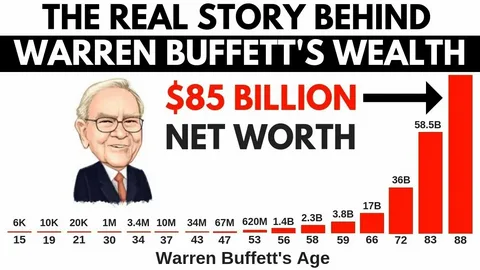

Warren Buffett’s net worth is a fascinating topic that reflects not just his investment acumen but also his unique approach to wealth. As of 2023, Buffett’s net worth hovers around an astonishing $118 billion, making him one of the richest individuals in the world. What sets Buffett apart is not merely the size of his fortune, but the principles behind it—he embodies a philosophy of long-term investing and value creation that many aspire to emulate. His wealth has grown significantly over the decades, showcasing a remarkable trajectory that mirrors the growth of his company, Berkshire Hathaway.

Examining Buffett’s net worth by age reveals a compelling story of patience and strategic foresight. He was already a millionaire by the age of 30, but it wasn’t until he turned 50 that his wealth skyrocketed into the billions. This progression highlights how compounding returns and disciplined decision-making can lead to extraordinary financial outcomes over time. Buffett’s real-time net worth fluctuates with market conditions, yet his focus on intrinsic value and sound business fundamentals has consistently positioned him as a beacon of financial wisdom. For those curious about wealth accumulation, his journey serves as both inspiration and a roadmap for sustainable success.

Read More: Jim Cramer Mad Money, Stock Picks, and Net Worth Insights

Warren Buffett yearly letter

Warren Buffett’s annual letters to Berkshire Hathaway shareholders are not just a reflection of the company’s performance; they serve as a masterclass in investing and business philosophy. The Berkshire Hathaway annual letters for 2021 and 2022 encapsulate Buffett’s timeless wisdom, offering insights into the economic climate, investment strategies, and his thoughts on corporate governance. In the 2021 letter, Buffett emphasized the resilience of American businesses amid challenges, showcasing how long-term investments can weather short-term volatility. He also highlighted the importance of understanding what you own, reinforcing the idea that knowledge is a critical component of successful investing.

In the 2022 Berkshire Hathaway annual letter, Buffett continued this narrative, addressing inflation concerns and their implications for future investments. His reflections on the evolving market landscape provide valuable lessons for both novice and seasoned investors. By dissecting the performance of Berkshire’s diverse portfolio, including notable acquisitions and divestments, Buffett offers a blueprint for making informed decisions. The letters collectively serve as a treasure trove of insights, encouraging readers to think critically about their investment choices while adhering to principles that have stood the test of time. As we look forward to future communications, Buffett’s annual letters remain essential reading for anyone interested in the art and science of investing.

Read More: Todd Palin Net Worth, Life Today, and Latest Updates

Warren Buffett Age

Warren Buffett’s net worth has seen a remarkable trajectory as he has aged, transforming him into one of the wealthiest individuals globally. At the age of 30, Buffett’s net worth was a modest $1 million, a sum that would grow exponentially over the decades. By the time he reached 40, his fortune had skyrocketed to around $25 million, driven by his astute investments and the founding of Berkshire Hathaway. The compounding effect of his investments is a testament to his investment philosophy, which emphasizes patience and a long-term perspective. As Buffett entered his 50s, his net worth crossed the billion-dollar mark, showcasing how consistent decision-making and a focus on value investing can yield extraordinary results.

As Warren Buffett approached his 60s, his net worth soared past $30 billion, positioning him as one of the richest men in the world. His ability to identify undervalued companies and invest wisely has only sharpened with age. Now in his 90s, Buffett’s net worth exceeds $100 billion, illustrating not just the power of compound interest but also his disciplined approach to investing. Despite his wealth, Buffett remains grounded, often emphasizing the importance of financial literacy and ethical investing. He continues to inspire new generations of investors with his insights on market dynamics and personal finance, proving that age is just a number when it comes to accumulating wisdom and wealth.

Read More: Averages Net Worth Temperature, Wages, Lifespan Essential Facts

Warren Buffett Wife

Warren Buffett’s relationship with his late wife, Susan Thompson Buffett, offers a poignant glimpse into the private life of one of the world’s most renowned investors. While much is known about Buffett’s financial acumen, Susan was a significant influence on his personal and philanthropic journey. Their marriage, which lasted over 50 years, was characterized by mutual respect and independence. Despite spending time apart due to Susan’s pursuit of her own career and passions, their bond remained unshakeable. This unique dynamic highlights the importance of nurturing individual aspirations within a partnership, a lesson that resonates with many couples today.

Susan’s legacy extends beyond her role as Buffett’s wife; she was a formidable philanthropist in her own right. She championed various causes, particularly in education and the arts, establishing the Susan Thompson Buffett Foundation, which continues to impact countless lives. Her commitment to social issues not only complemented Warren’s business endeavors but also inspired him to think beyond mere wealth accumulation. This collaboration in values and vision underscores how shared goals can elevate both partners, enriching their lives and those around them. In reflecting on their life together, it becomes clear that love can be both a partnership and an individual journey, where each person thrives in their own light while supporting the other.

Read More: Latest Davido Songs, Net Worth, Concerts, and Updates

Warren Buffett Net Worth in billion

As of 2024, Warren Buffett’s net worth is projected to be around $118 billion, reaffirming his status as one of the wealthiest individuals in the world. This staggering figure not only highlights his investment prowess but also reflects a life dedicated to value investing and long-term financial strategies. Over the decades, Buffett’s net worth has evolved significantly; for instance, at age 40, his wealth was just under $1 billion, showcasing an extraordinary compound growth that few can match.

When expressed in Indian Rupees, Buffett’s net worth translates to approximately ₹9.8 lakh crores, demonstrating the vast scale of his financial empire on a global stage. A graph illustrating his net worth over time reveals a remarkable trajectory, particularly post-2000, where strategic investments in companies like Apple and Coca-Cola propelled him into the billionaire stratosphere. Meanwhile, insights into his family reveal that both his daughter, Susie Buffett, and wife, Astrid Menks, have their own financial standings, contributing to a legacy that extends beyond mere numbers. Their involvement in philanthropy further illustrates that the Buffett legacy is not just about accumulating wealth but also about making a meaningful impact in society.

Read More: Hard Rock Nick dead, Wikipedia, net worth, wife, age, real name

Warren Buffett Children

Warren Buffett’s commitment to philanthropy is evident not only in his own charitable endeavors but also through the initiatives championed by his children. His three children, Susan, Howard, and Peter, have taken the baton, actively participating in various charitable foundations. The Susan Thompson Buffett Foundation, for instance, focuses on education and reproductive health, reflecting the values instilled in them by their father. This generational shift shows how Buffett’s legacy extends beyond wealth accumulation to fostering a culture of giving back.

In terms of education, Buffett has emphasized the importance of financial literacy among young people, which is mirrored in his children’s pursuits. They have engaged in initiatives that promote educational access, ensuring that future generations have the tools necessary to thrive. Moreover, the whimsical world of children’s literature has also been touched by Buffett’s influence; his books geared towards young readers aim to demystify finance and investing, making these concepts accessible and engaging. The children’s cartoon inspired by Buffett’s principles further emphasizes this goal, blending entertainment with valuable life lessons about money management and ethical decision-making.

Buffett’s unique perspective on inheritance is another intriguing aspect of his family dynamics. He famously stated that he would leave his children enough money to do anything but not enough to do nothing, highlighting his belief in self-sufficiency and personal growth. This philosophy resonates deeply within the Buffett family as they navigate their roles in philanthropy and business, ensuring that wealth serves as a tool for positive impact rather than a crutch. Through their charitable endeavors and educational initiatives, Warren Buffett’s children embody the spirit of giving that their father has championed throughout his life.

Read More: Elon Musk: Net Worth, SpaceX, Tesla Robots, Satellites & More

Warren Buffett Children Net Worth

Warren Buffett’s children, while not as publicly scrutinized as their father, have carved out their own unique paths and fortunes. Each of his three children—Susie, Howard, and Peter—has pursued endeavors that reflect their individual passions. For instance, Susie has made a significant impact in the realm of philanthropy and the arts, co-founding the Sherwood Foundation, which focuses on education and community development. Howard and Peter, meanwhile, have ventured into investment and management, with Howard serving as the CEO of Berkshire Hathaway Energy. Collectively, their net worth is estimated to be in the hundreds of millions, showcasing how they have leveraged both their father’s teachings and their own skills.

Interestingly, the Buffett children are known for their grounded approach to wealth. They have publicly stated that they do not expect to inherit massive fortunes from their father but rather wish to use their resources to create positive change in society. This mindset not only reflects Warren Buffett’s own philosophy on wealth distribution but also highlights a generational shift in how money is perceived and utilized. Their commitment to philanthropy and responsible investing positions them as modern stewards of their father’s legacy, emphasizing that true wealth lies not just in monetary value but in the impact one can make on the world.

Read More: Mark Zuckerberg Net Worth, Meta, Instagram, Family, and More

Warren Buffett Annual Shareholders Letter

Warren Buffett’s annual shareholders letter is not just a financial document; it’s a masterclass in investment philosophy and a reflection of the broader economic landscape. Each year, Buffett distills complex market trends into accessible insights, making it a must-read for investors of all levels. This year, he emphasized the importance of long-term thinking, encouraging shareholders to view volatility as an opportunity rather than a threat. His candid discussions on mistakes and missed opportunities provide invaluable lessons on humility and adaptability in an ever-changing market.

Moreover, Buffett’s reflections on corporate governance highlight the significance of ethical leadership and transparency. He often contrasts his own management style with that of other companies, advocating for a culture that prioritizes shareholder interests while fostering innovation. This year, his focus on sustainability and responsible investing reveals a shift towards not just financial returns but also social impact, urging investors to consider the long-term ramifications of their choices. By weaving personal anecdotes with economic data, Buffett crafts a narrative that resonates deeply, reminding us that investing is as much about character and values as it is about numbers.

Read More: Jeff Bezos His Wealth Mega Yacht Space Ventures Personal Life

Warren Buffett Houses

Warren Buffett, the Oracle of Omaha, is known for his shrewd investment strategies, but his approach to real estate is equally intriguing. Contrary to what one might expect from a billionaire, Buffett’s personal residence is a modest, unassuming home in Omaha, Nebraska, which he purchased in 1958 for just $31,500. This choice reflects his philosophy of value over extravagance; he has often emphasized that wealth should be a tool for living well rather than a display of luxury. By opting for a home that embodies simplicity and practicality, Buffett challenges societal norms about success and materialism.

Interestingly, Buffett’s real estate holdings extend beyond his primary residence. He owns several other properties, including a vacation home in California’s Laguna Beach, showcasing his appreciation for serene environments without the ostentation typical of many affluent individuals. This strategic diversification in property ownership highlights his acumen not just as an investor but as a man who understands the value of place and community. His choices serve as a reminder that true wealth lies in experiences and connections rather than sheer opulence. Ultimately, Buffett’s housing choices provide a lens into his character: frugal yet wise, grounded yet aspirational—traits that continue to inspire millions around the globe.

Warren Buffett letter from

Warren Buffett’s letters to shareholders are more than just annual reports; they are a masterclass in investment philosophy and business acumen. Each letter encapsulates Buffett’s unique ability to distill complex financial concepts into relatable narratives, offering readers insights that extend beyond mere numbers. For instance, his reflections on market fluctuations often emphasize the importance of a long-term perspective, reminding investors that short-term volatility is a natural part of the investment landscape. This approach encourages a mindset shift—seeing opportunities in downturns rather than succumbing to panic.

Moreover, Buffett’s wit and wisdom shine through in his anecdotes, which often serve as lessons in humility and patience. He uses storytelling not just to entertain but to reinforce critical investment principles, such as the value of thorough research and the significance of understanding the businesses behind stocks. By weaving personal experiences into his letters, Buffett creates a relatable narrative that resonates with both seasoned investors and novices alike, bridging the gap between theory and practice. These letters are not just historical documents; they are living guides that continue to inspire generations of investors to adopt a disciplined approach in their pursuit of financial success.

Warren Buffett Get Rich

Warren Buffett’s journey to wealth is not just a tale of savvy investing; it’s a masterclass in patience and discipline. Unlike many who chase quick profits, Buffett has always advocated for a long-term perspective. His philosophy centers around buying quality businesses at reasonable prices and holding them through market fluctuations. This approach fosters an intimate understanding of the companies he invests in, allowing him to navigate economic downturns with confidence.

Moreover, Buffett’s ability to remain grounded amidst his immense wealth is striking. He famously continues to live in the same modest home in Omaha, Nebraska, demonstrating that true richness lies not in material possessions but in relationships and integrity. This mindset has not only shaped his investment strategies but also his philanthropic endeavors, where he emphasizes giving back to society as a fundamental principle of success. By focusing on long-term growth and ethical stewardship, Buffett offers a refreshing perspective that challenges the conventional wisdom of wealth accumulation.

Warren Buffett Ownership of Berkshire

Warren Buffett’s ownership of Berkshire Hathaway is not just a matter of financial investment; it’s a reflection of his lifelong philosophy on value, patience, and the power of compound interest. When Buffett took control of the struggling textile company in 1965, few could have imagined that he would transform it into one of the most influential conglomerates in the world. His approach to ownership is rooted in a deep understanding of the businesses he acquires—not merely as assets, but as companies with potential for growth, innovation, and long-term sustainability. This perspective has allowed him to cultivate a diverse portfolio, ranging from insurance to technology, while staying true to his core principles of ethical business practices.

Buffett’s unique position as both CEO and the largest shareholder has fostered an unparalleled culture within Berkshire Hathaway. He champions a decentralized management style that empowers subsidiary leaders to operate autonomously, instilling a sense of ownership throughout the organization. This trust has led to remarkable loyalty and performance across its various holdings, creating a business ecosystem where innovation thrives. Furthermore, Buffett’s commitment to transparency and shareholder communication sets a standard in corporate governance that resonates with investors worldwide, making Berkshire Hathaway not just a financial powerhouse but a model for how businesses can be run ethically and effectively.

Warren Buffett Owner earnings

Warren Buffett’s concept of owner earnings has become a cornerstone of value investing, transcending traditional metrics like net income. Owner earnings focus on the actual cash generated by a business that can be distributed to shareholders, reflecting a clearer picture of financial health. This approach emphasizes the importance of cash flow over accounting profits, allowing investors to assess a company’s true earning potential. By calculating owner earnings—net income plus non-cash charges like depreciation and amortization, minus capital expenditures—Buffett provides a more nuanced understanding of how much money a business can realistically generate for its owners.

What makes owner earnings particularly compelling is its adaptability across different industries. For instance, a tech startup might have substantial net income but low owner earnings due to high reinvestment needs, while a mature utility company may show modest net income yet robust owner earnings due to stable cash flows. This lens encourages investors to dig deeper into financial statements and consider long-term sustainability rather than chasing fleeting profits. In an era where market volatility often blurs the lines of financial performance, Buffett’s emphasis on owner earnings serves as a beacon, guiding investors toward businesses that not only thrive but also reward their shareholders consistently over time.

Warren Buffett owner of walmart

Warren Buffett, the Oracle of Omaha, is often celebrated for his investment acumen and long-term strategies, yet the idea of him owning Walmart invites a deeper exploration of retail dynamics. While Buffett has never held a controlling stake in the retail giant, his investment philosophy mirrors Walmart’s core principles: efficiency, value, and a focus on customer satisfaction. If he were to take the helm, one could envision a paradigm shift in how Walmart operates, perhaps emphasizing sustainability and ethical sourcing even more than it currently does.

Moreover, Buffett’s approach to management might lead to innovative expansions into e-commerce, leveraging Walmart’s existing infrastructure to compete with giants like Amazon. His knack for identifying undervalued assets could inspire a reinvigoration of Walmart’s brand, promoting local partnerships and community engagement that resonate with today’s consumers who prioritize social responsibility. This imagined synergy between Buffett’s investment strategies and Walmart’s operational model could redefine not only retail but also set new standards for corporate responsibility in an era where consumers demand more than just low prices.

Warren Buffett ownership of apple

Warren Buffett’s investment in Apple Inc. represents a remarkable evolution in his traditional value-investing philosophy. Initially skeptical of technology stocks, Buffett’s stake in Apple has since become one of Berkshire Hathaway’s most significant holdings, highlighting his ability to adapt and recognize the changing landscape of consumer behavior and technology’s role within it. The allure of Apple’s brand loyalty and its ecosystem of products and services captivated Buffett, who famously noted that he doesn’t just buy companies; he buys great companies with strong competitive advantages.

What’s particularly fascinating is how Buffett’s investment mirrors broader economic trends, such as the increasing reliance on digital technology and the shift towards a service-oriented economy. Apple’s robust cash flow generation and consistent innovation have positioned it not just as a tech giant but as a quintessential consumer staple in the modern age. This strategic pivot emphasizes Buffett’s belief in the importance of understanding the underlying business model over merely focusing on historical financial metrics. His ownership of Apple serves as a testament to how even seasoned investors must continually evolve their strategies to capture the growth potential of companies that resonate deeply with consumers’ lives today.

Warren Buffett ownership in OXY

Warren Buffett’s investment in Occidental Petroleum (OXY) has captured the attention of market watchers, not just for its scale but for the strategic foresight it represents. Buffett, known for his value-driven approach, saw potential in OXY at a time when many were skeptical about the oil and gas sector’s future. His decision to amass a significant stake highlights his belief in the company’s ability to navigate a volatile energy landscape, particularly as global demand for oil remains resilient amid shifting geopolitical dynamics.

What makes this investment particularly intriguing is Buffett’s willingness to engage in unconventional financing tactics, such as issuing preferred shares and options, which reflects a nuanced understanding of risk and reward. This approach not only bolsters OXY’s capital structure but also aligns with Buffett’s philosophy of leveraging opportunities that others might overlook. As the energy transition continues to evolve, Buffett’s confidence in OXY positions it as a potential bridge between traditional energy sources and the burgeoning renewable sector, suggesting that he sees long-term value where many see short-term challenges.

Warren Buffett BYD Stock

Warren Buffett’s interest in BYD stock is a testament to his forward-thinking investment strategy, particularly in the realm of sustainable energy and electric vehicles. As the world increasingly shifts toward greener alternatives, Buffett has recognized BYD’s potential to not only thrive in the burgeoning EV market but also to lead it. The company’s vertical integration—from battery production to vehicle assembly—positions it uniquely against competitors, showcasing a level of operational efficiency that investors find compelling.

Moreover, BYD’s commitment to innovation, exemplified by its rapid advancements in battery technology, aligns with Buffett’s philosophy of investing in companies that are not just surviving but innovating for the future. The recent surge in global EV demand amplifies this perspective; BYD stands ready to capitalize on this trend with a robust lineup of affordable and efficient vehicles. As regulatory frameworks across major economies tighten emissions standards, BYD is poised to benefit significantly, making Buffett’s stake not just a bet on a single company, but on the future of transportation itself.

Conclusions

In conclusion, Warren Buffett’s remarkable journey from a young entrepreneur to one of the wealthiest individuals in the world is truly inspiring. His net worth, age, and personal life reflect not just his financial acumen but also his commitment to philanthropy and ethical business practices. With decades of experience in investing and a keen understanding of market dynamics, Buffett continues to influence countless investors globally. As he shares insights into his life and investment strategies, we are reminded that success is not just about wealth, but also about wisdom and giving back. For more in-depth information on Buffett’s life and lessons, explore our full guide.

To sum up, Warren Buffett’s life story is a testament to hard work, strategic thinking, and the importance of maintaining strong personal values. His impressive net worth and longevity in the investment world serve as benchmarks for aspiring entrepreneurs everywhere. Beyond numbers, Buffett’s relationships and philanthropic efforts reveal a man dedicated to making a positive impact. As we delve deeper into his life, we uncover not only financial strategies but also life lessons that resonate with many. Don’t miss out on exploring more about this legendary investor by reading our complete article.

Leave a Reply